Standard Life – Three Simple Steps to Pension Positivity

Standard Life (The Hills Group’s pension provider) offers some excellent advice to the following pension questions:

- Do you know what income you can expect in retirement?

- Are you sure you know where all your pension savings are?

- What income will you need to enjoy the lifestyle you want in retirement?

Click here to see their leaflet – and download the Standard Life App to to get started:

Government Pension Advice

The government’s Money Helper website is a rich resource of impartial advice on lots of financial matters including pensions and retirement.

Employee pension schemes

Company pension contact details:

Standard Life (The Hills Group’s pension provider)

Call: 0800 970 4131

Website: Pensions | Standard Life

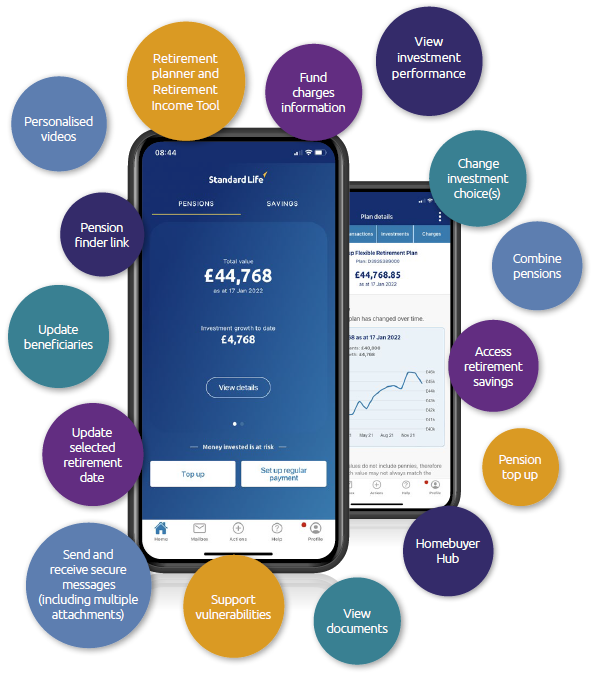

You can also use the Standard Life mobile app for easy access to pension tools, planners, investment updates and more. Find the app on your phone’s official app-store.

The Standard Life website features a number of ‘How To’ videos explaining how to get the most out of the app including how to add a beneficiary: standardlife.co.uk/app/how-to-videos

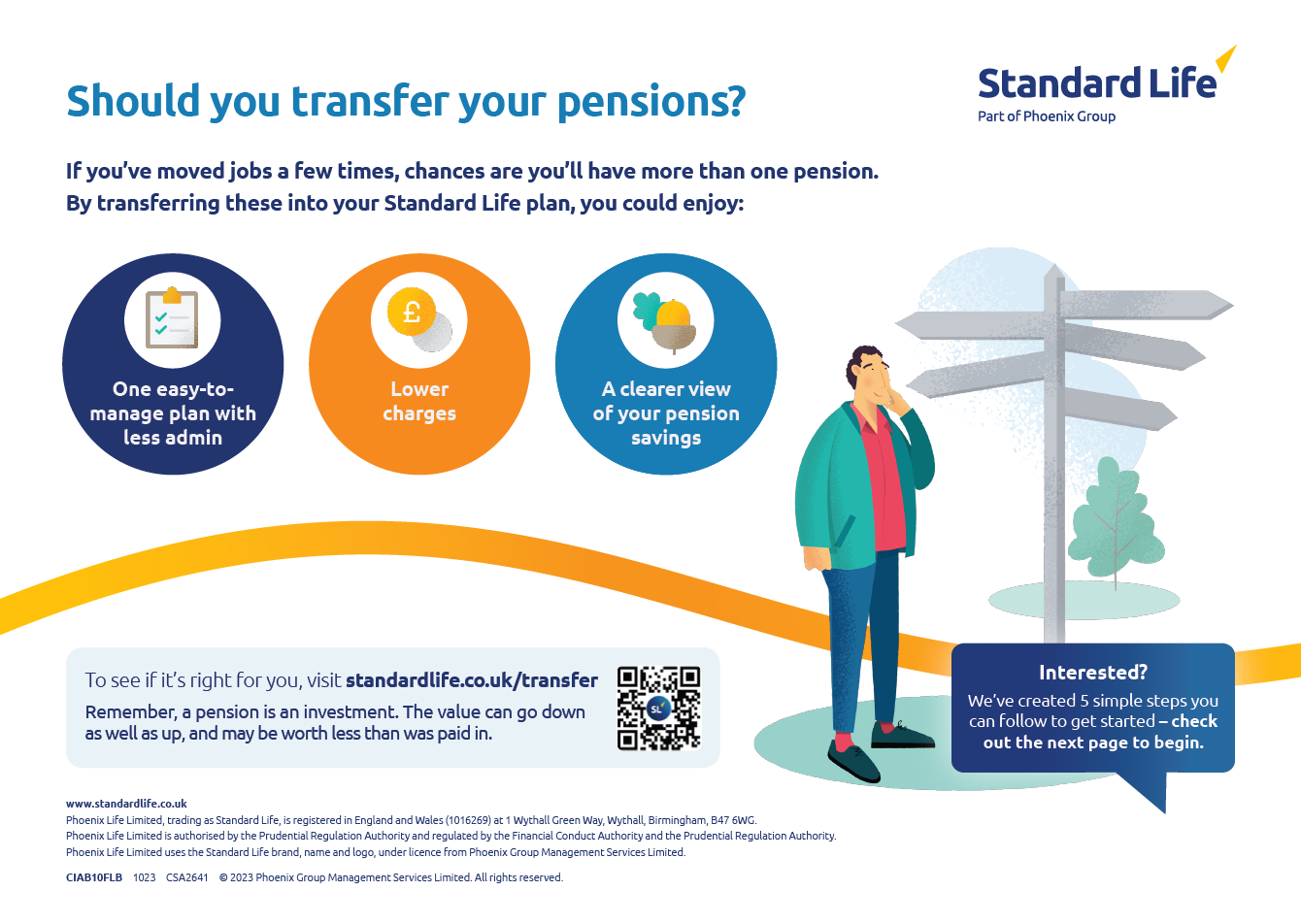

Is combining pensions right for you?

If you’ve moved jobs a few times, chances are you may have more than one pension. Hills’ pension provider Standard Life offers some advice and five simple steps to transfer a pension – click here.

Standard Life Retirement tools:

Retirement Income Tool Video

Money Mindset Video

Pre–Retirement Support Video

Retirement Options & Tools Video

Plan for your Future Video

Standard Life Cost of Living support:

Uncertain times and market fluctuations – what this means for your pension

Help & Support for financial difficulties during the Cost of Living crisis

Money Plus Blog

Financial Health Check Tool

Wiltshire Pension Fund

Call 01225 713613 or email pensionenquiries@wiltshire.gov.uk

Website: Welcome to our Member website – Wiltshire Pension Fund Member Area